Ohio Tax Calculator

Ohio Income Tax Calculator - SmartAsset

Sales tax: 6.5% - 8%. Property tax: 1.48% average effective rate. Gas tax: 38.50 cents per gallon of regular gasoline and 47.00 cents per gallon of diesel. Starting in 2005, Ohio’s state income taxes saw a gradual decrease each year. For the 2021 tax year, which you file in early 2022, the top rate is 3.99%.

https://smartasset.com/taxes/ohio-tax-calculator

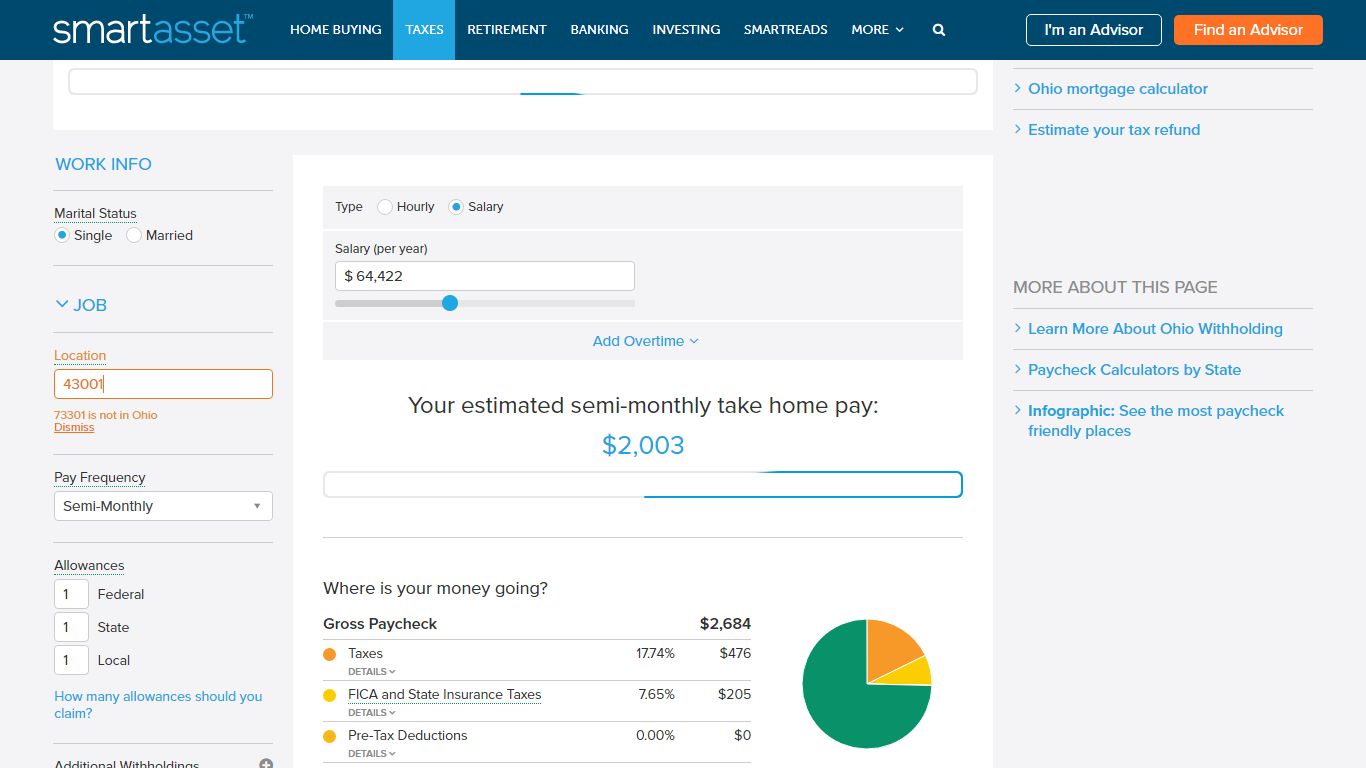

Ohio Paycheck Calculator - SmartAsset

Ohio Paycheck Calculator Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Overview of Ohio Taxes Ohio has a progressive income tax system with six tax brackets. Rates range from 0% to 3.99%.

https://smartasset.com/taxes/ohio-paycheck-calculator

Ohio Tax Calculator: Estimate Your Taxes - Forbes Advisor

Income Tax Calculator 2021 Ohio Ohio Income Tax Calculator 2021 If you make $70,000 a year living in the region of Ohio, USA, you will be taxed $10,957. Your average tax rate is 11.98% and your...

https://www.forbes.com/advisor/income-tax-calculator/ohio/Ohio Tax Calculator

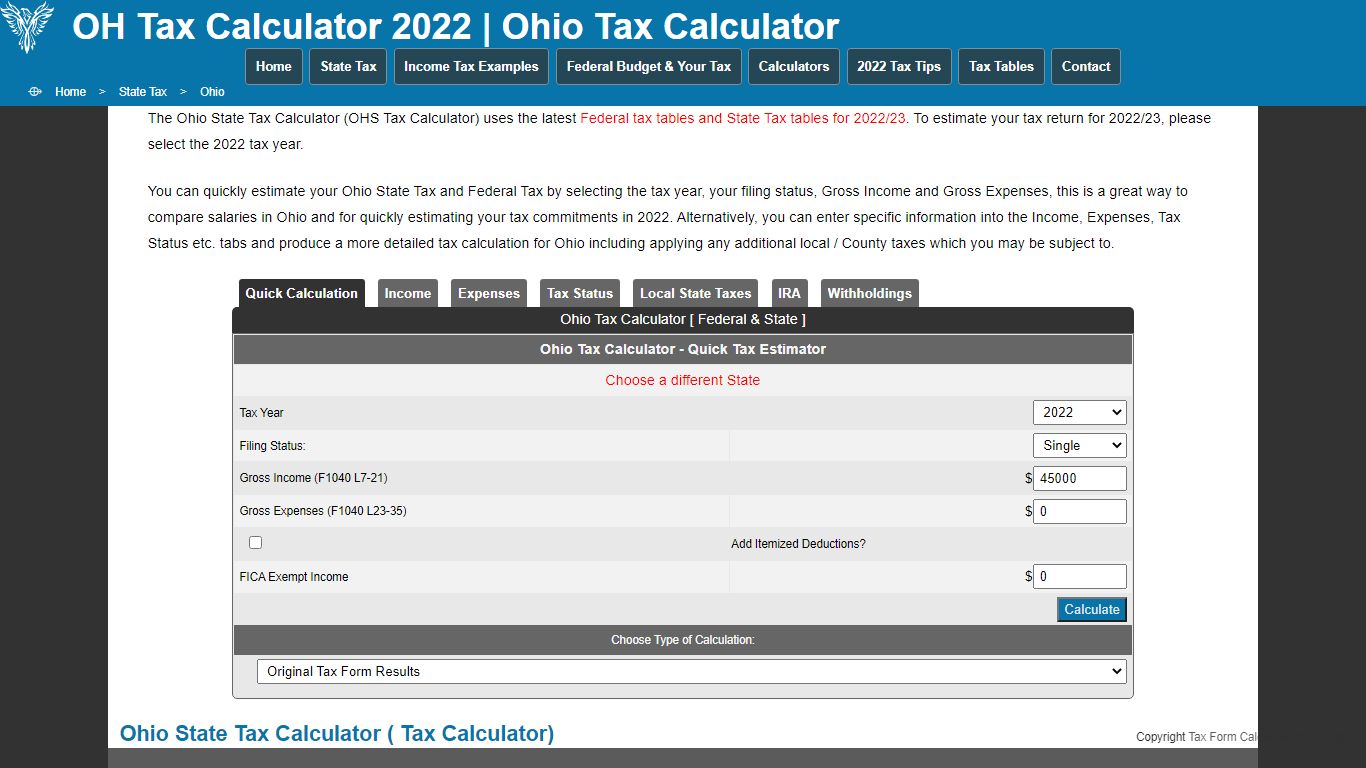

Ohio State Tax Calculator ( Tax Calculator) The Ohio tax calculator is updated for the 2022/23 tax year. The OH Tax Calculator calculates Federal Taxes (where applicable), Medicare, Pensions Plans (FICA Etc.) allow for single, joint and head of household filing in OHS. The Ohio income tax calculator is designed to provide a salary example with salary deductions made in Ohio.

https://www.taxformcalculator.com/state-tax/ohio.html

Ohio Sales Tax Calculator - SalesTaxHandbook

Ohio Sales Tax Calculator You can use our Ohio Sales Tax Calculator to look up sales tax rates in Ohio by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Amount Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/ohio/calculator

Ohio State Tax Calculator - Good Calculators

You are able to use our Ohio State Tax Calculator to calculate your total tax costs in the tax year 2022/23. Our calculator has recently been updated to include both the latest Federal Tax Rates, along with the latest State Tax Rates. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying, but a breakdown of all the tax costs that will be taken, with consideration to any deductions that they are able to receive.

https://goodcalculators.com/us-salary-tax-calculator/ohio/

Ohio Sales Tax Calculator - Tax-Rates.org

Average Local + State Sales Tax. The Tax-Rates.org Ohio Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Ohio. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Ohio, local counties, cities, and special taxation districts.

https://www.tax-rates.org/ohio/sales-tax-calculator

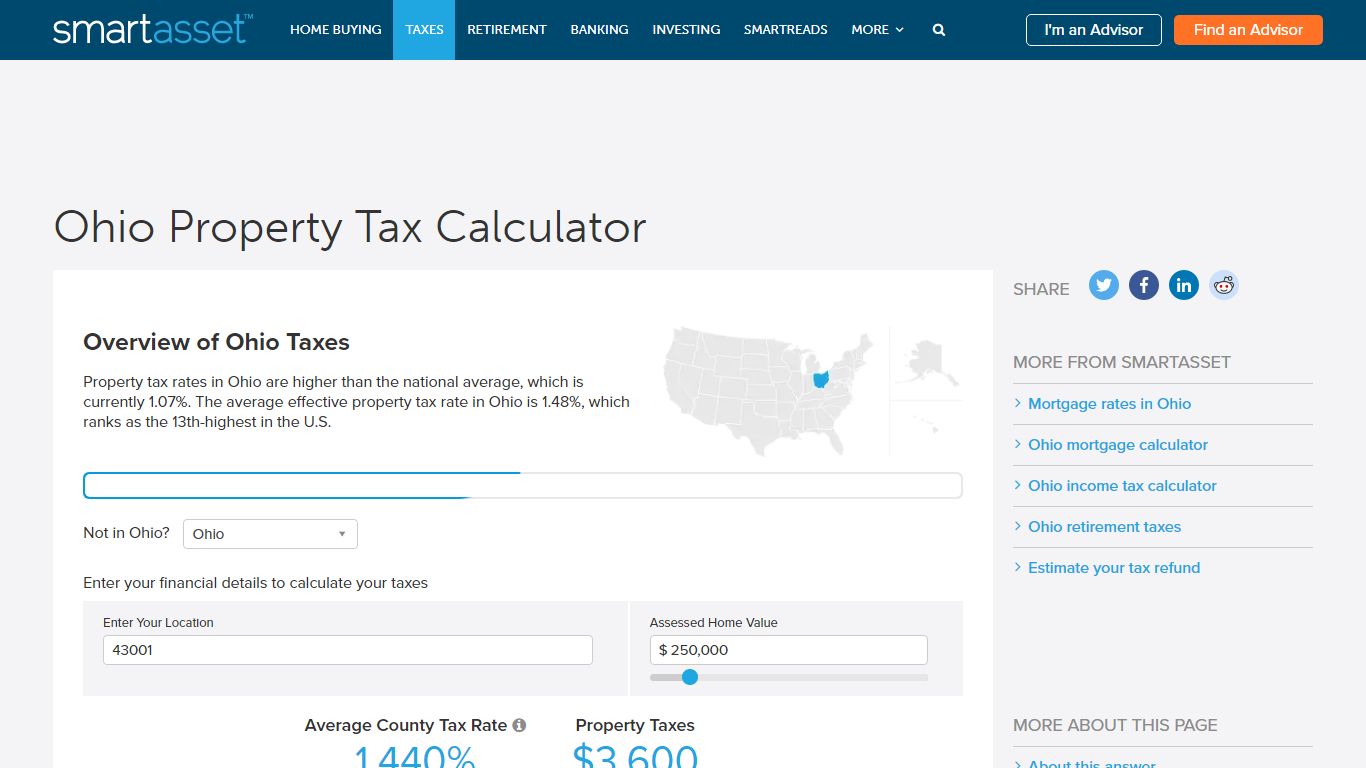

Ohio Property Tax Calculator - SmartAsset

Appraised values should equal 100% of market value. However, assessed values in Ohio – the amounts on which property taxes are based – are calculated at 35% of appraised value. So, for example, if your property is worth $100,000, your assessed value should be $35,000.

https://smartasset.com/taxes/ohio-property-tax-calculator

Ohio Paycheck Calculator 2022 with Income Tax Brackets

Ohio Income Tax Calculator Find out how much your salary is after tax so you can have a better idea of what to expect when planning your budget 9 Ratings See values per: Year Month Biweekly Week Day Hour Results Salary Before Tax $ 0 Salary After Tax $ 0 Total Tax $ 0 Average Tax Rate 0 % $ = US Dollar 0% Net Pay 0% Total Tax Detailed Breakdown

https://investomatica.com/income-tax-calculator/united-states/ohio

Ohio Paycheck Calculator | ADP

Salary Paycheck Calculator Ohio Paycheck Calculator Use ADP’s Ohio Paycheck Calculator to estimate net or “take home” pay for either hourly or salaried employees. Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest.

https://www.adp.com/resources/tools/calculators/states/ohio-salary-paycheck-calculator.aspx

Free Ohio Payroll Calculator | 2022 OH Tax Rates | OnPay

Luckily, our payroll calculator is here to help you avoid any payroll tax fiascos. The process is simple. All you have to do is enter each employee’s wage and W-4 information, and our calculator will process their gross pay, deductions, and net pay for both Ohio and Federal taxes. Launch Free Calculator OR See Ohio tax rates Federal Payroll Taxes

https://onpay.com/payroll/calculator-tax-rates/ohio